Pune’s industrial belt is rapidly becoming a cornerstone of India’s electric mobility ecosystem.

Many battery gigafactories and EV powertrain plants have been set up here, supplying domestic OEMs and global clients. Over the past two years, Pune has attracted heavy investment in battery cell, pack and battery energy storage manufacturing.

For example, Pune’s Chakan manufacturing hub (a 2.83 km², water-positive zone) now hosts multiple EV facilities running on renewable power. Together these projects – from two-wheeler packs to high-capacity electric SUV batteries – mark Pune as a de facto national battery capital.

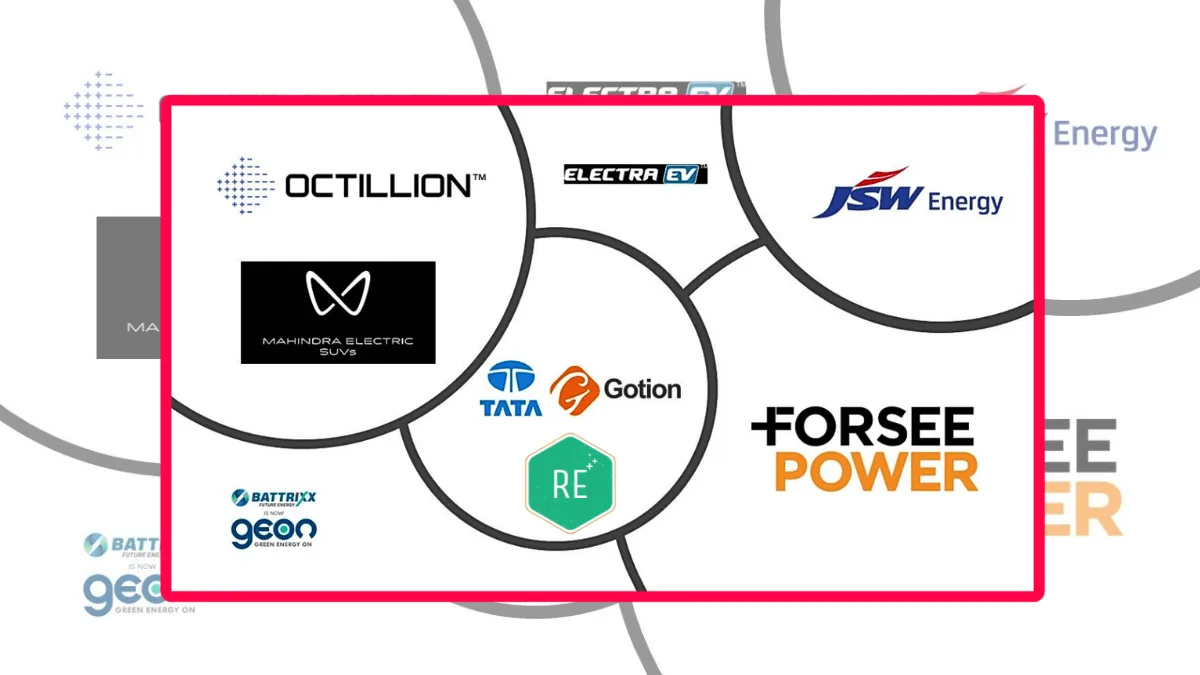

It has manufacturing lines in Pune (and also at Sanand, Gujarat) producing lithium-ion packs for Tata’s EVs. Until 2024, TACO Gotion was Tata’s sole pack supplier (using Gotion prismatic cells) for models like the Nexon EV and the larger-battery Curvv.

The Pune factory (100,000+ sq. ft) now aims for roughly 6 GWh annual output, and Tata plans to expand capacity in phases (up to ~20 GWh) with investments of thousands of crores.

Beyond Tata Group, the JV is exploring new clients and aligning with Tata Chemicals’ Agratas cell venture for vertical integration.

The new facility (about 15,000 m²) began operations with an initial 2.0 GWh annual capacity. It builds cylindrical-cell battery packs and modules for commercial EVs, focusing on leading LCV and bus makers.

Octillion’s biggest customer in India is Tata Motors – the 45 kWh Curvv SUV uses Octillion packs – and the firm has quietly signed up more domestic OEMs.

To meet demand, Octillion is adding manufacturing lines (including LFP chemistry) and sourcing cells domestically.

The company’s India revenue nearly quadrupled in early 2024, reflecting orders from major EV brands.

This French battery maker launched its Pune plant in mid-2021. Located in Chakan 35 km north of Pune, Forsee’s factory was designed for light EVs (two-/three-wheelers and commercial LCVs).

It started serial output in May 2021 and aims to reach 1 GWh yearly by 2025. Customers include 2W/3W and small EV players under the FAME incentive.

Forsee Power India already supplies batteries to local e-rickshaws and light truck manufacturers.

The plant is certified for quality and sustainability (ISO standards) and is scaling up: it will add lines and invest €13+ million in a second phase, ultimately targeting ~5 GWh by 2027.

Founded by industry veterans, REPLUS serves sectors such as mobility, renewable energy, industrial storage, and telecom.

Its Pune facility focuses on advanced engineering for lithium-ion and lithium-sodium chemistries, smart BMS, and system integration.

The company is actively scaling its manufacturing footprint to cater to India’s growing green energy and EV sectors.

Backed by the Tata family, Pune-based Electrodrive Powertrain Solutions (Electra EV) was founded in 2017 as a powertrain systems startup. It runs an R&D and testing centre in Pune (and a larger assembly facility in Coimbatore).

Electra designs and builds full EV powertrains – battery packs, drive units, electronics – for passenger and commercial vehicles. It has raised over $25 million (2022) to broaden its portfolio across 3W/4W and agri-EVs.

Major customers include Tata Motors (its Xpress-T electric fleet and Ace EV deliveries).

Electra’s Pune team focuses on high-performance, localized EV kits; its current output is roughly 1–1.5 GWh per year, with plans to increase capacity and unveil new energy products (including UK tech partnerships).

Initial reports indicate a first-phase ~1 GWh line near Pune, focusing 70% on renewable storage and 30% on EVs.

This aligns with JSW’s plan to launch EV products (buses/trucks, then cars).

The group aims to invest ~₹10,000 crore in related projects through its JSW Neo Energy unit and is scouting partnerships with cell makers.

In short order JSW looks to establish Pune as its battery node, mirroring its large-scale energy investments.

Geon (Green Energy ON) is an Indian battery startup that recently rebranded from Battrixx (founded ~2020 under Kabra Extrusiontechnik). It makes lithium-ion battery packs and energy storage systems for EVs and grids.

Geon has built a midsize plant in Chakan/Pune (with about 7 GWh planned capacity) to serve 2W/3W OEMs and fleet operators. In January 2025 the company announced ₹300 crore investment to expand domestic manufacturing, adding a new gigafactory at Chakan.

Geon’s product line includes proprietary LFP cells and smart BMS; it is exploring next-gen chemistries (e.g., lithium-sodium). By localizing packs and electronics, Geon typifies Pune’s push toward “Make-in-India” batteries for green transit.

Unveiled January 2025, the ₹4,500 crore plant sits in the 2.83 km² EV hub and is designed for fully automated production of Mahindra’s Electric Origin SUVs (e.g., BE.06 and XUV 9e).

Its compact battery line uses patented processes and 4.0 tech to assemble high-volume packs.

Notably, Mahindra’s packs use “blade” LFP cells sourced from BYD (China).

Although mainly for Mahindra’s models (Thar.e, BE.05/XUV.X Hydrogen, etc.), the Coimbatore-linked plant significantly boosts Pune’s battery output.

The group’s overall EV spending is ₹16,000+ crore through 2027; the Chakan battery line (capacity ~5 GWh/year by some estimates) is a key piece of that strategy.

Read More:

This post was last modified on April 28, 2025 11:52 am

In India, the automotive and transport industry is undergoing significant changes. This transformation isn't just about improving roads and infrastructure;…

Montra Electric, the clean mobility brand from the prestigious Murugappa Group, has launched the All-New Super Auto, a next-generation electric…

Union Minister Nitin Gadkari (Minister of Road Transport and Highways of India) has once again made a bold statement that’s got…

India’s electric four-wheeler (E4W) market slowed in September 2025, following a record-breaking August, with 15,038 units sold, representing an 18%…

India’s EV market hit 1,04,056 electric two-wheeler sales in September 2025. TVS, Bajaj, and Ather led the chart, while Ola…

India's electric two-wheeler market is growing at a record pace. In July 2025, over 1.2 lakh electric two-wheelers were sold,…

This website uses cookies.