At launch, Tesla will offer the Model Y in two variants—Rear-Wheel Drive and Long-Range RWD—with deliveries expected to begin in Q3–Q4 2025. A local Model 3 is lined up to arrive later this year

As India is a highly price-sensitive market, the biggest concern surrounding Tesla’s entry is its pricing.

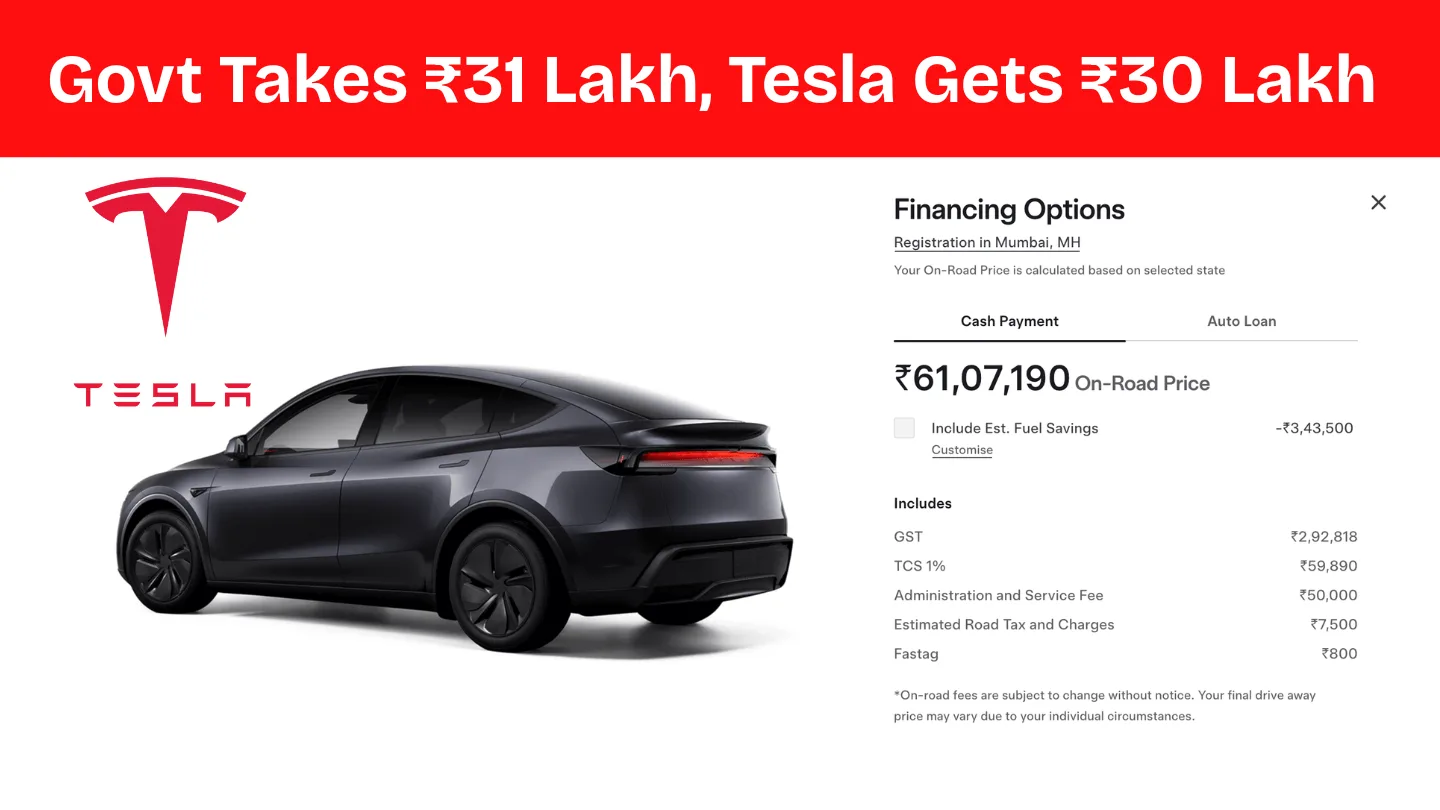

While the base price of the Tesla Model Y in the U.S. is $37,490 (approximately ₹30 lakh)—almost the same as the expected price of the Mahindra XEV 9E—heavy import duties, GST, and other taxes push the final cost in India to over ₹60 lakh.

| Component | Amount |

|---|---|

| US Base Price | ₹30 lakh ($37,490) |

| Import Duty (70%) | ₹19.39 lakh |

| GST (28%) | ₹7.75 lakh |

| GST Compensation Cess | ₹2.75 lakh |

| Ex-Showroom Price | ₹59.89 lakh |

| Road Tax + Insurance (est.) | ₹3.5 lakh |

| On-Road Price (Approx.) | ₹61 lakh |

Source: Tesla India Website

India currently levies one of the highest duties on fully imported electric vehicles—a 70% import tax on EVs priced below $40,000 and 100% on those above that.

Additionally, a GST rate of 28% plus a compensation cess of up to 22% applies to luxury vehicles, regardless of the fuel type.

While mass-market EVs made in India are taxed at just 5% GST, imported premium EVs like Tesla are treated at par with ICE luxury cars.

This approach prioritises revenue over accessibility, raising an important question:

Is India using EV imports as a cash cow, even as it claims to push for a greener future?

Tesla’s Model Y is a perfect case study in this policy paradox.

For every ₹1 a buyer pays, nearly ₹0.51 goes to the government.

The manufacturer, who brings in the innovation and the product, takes less than half of the total transaction value.

At this pricing, the Model Y is competing with the likes of Mercedes EQB, BMW iX1, and Audi Q4 e-tron—all of which face similar tax burdens.

India recently approved a policy offering 15% concessional duty on 8,000 imported EVs/year, provided the company invests at least ₹4,150 crore and begins local production within 3 years.

While Tesla hasn’t officially confirmed local manufacturing, early indicators suggest it may comply to gain access to lower duties. The Mumbai showroom, inaugurated in July 2025, is just the first step.

Karnataka and Maharashtra are reportedly lobbying hard for Tesla’s EV plant.

But until that happens, imported Teslas will remain in the ₹60–70 lakh bracket—affordable to only a few.

India wants 30% of new car sales to be electric by 2030, but:

EVs make up less than 2% of private car sales today.

Infrastructure is nascent, especially outside Tier-1 cities.

Premium EV adoption is slowed by high taxation and pricing.

If India wants EVs to be mainstream, especially in the premium segment, pricing parity is essential—and that can only come through local manufacturing or a rethinking of tax policy.

Supporters of the current system argue that:

India must protect its local auto industry.

High taxes fund public goods and infrastructure.

Only ultra-wealthy buyers are affected today.

Critics counter that:

Excessive duties on EVs contradict climate goals.

Tesla’s entry could catalyse the entire EV supply chain.

Lower duties can still generate long-term tax revenue via scale.

This post was last modified on July 16, 2025 11:50 am

Montra Electric, the clean mobility brand from the prestigious Murugappa Group, has launched the All-New Super Auto, a next-generation electric…

Union Minister Nitin Gadkari (Minister of Road Transport and Highways of India) has once again made a bold statement that’s got…

India’s electric four-wheeler (E4W) market slowed in September 2025, following a record-breaking August, with 15,038 units sold, representing an 18%…

India’s EV market hit 1,04,056 electric two-wheeler sales in September 2025. TVS, Bajaj, and Ather led the chart, while Ola…

India's electric two-wheeler market is growing at a record pace. In July 2025, over 1.2 lakh electric two-wheelers were sold,…

The future of mobility in India has taken a major leap forward. Omega Seiki Mobility (OSM), led by Founder Uday…

This website uses cookies.