According to Researcher & Research LLC, the top 20 best-selling electric vehicles (EV) models account for 55.7% of the Chinese EV market, as shown in the figure below.

Compared to 59.8% in 2020, it decreased by 4.1%, mainly due to a more pronounced concentration of the market in the top 15 models in 2021.

If the total market share of the top 25 models is used for comparison, the market share in 2021 increases compared to 2020, as the gap between the 21st and 25th models and the 16th and 20th models in 2021 was reduced And there was more than that

Therefore, in 2021, not only did the market share of the top 15 models in China’s EV market increase but more than 60% of the sales were concentrated on the top 25 models.

It should be noted that, except for Tesla Model Y and Model 3, the rest of the other top 20 models all belonged to Chinese EV OEMs, and the trend of Chinese EV OEMs dominating the sales was more obvious than in 2020.

This shows that the sales power of non-Chinese EV OEMs in China has declined significantly while Chinese EV OEMs captured a larger market share in 2021.

However, not all Chinese EV OEMs shared profits equally; For example, BYD, XPeng, and Hozon grew, while Weltmeister declined.

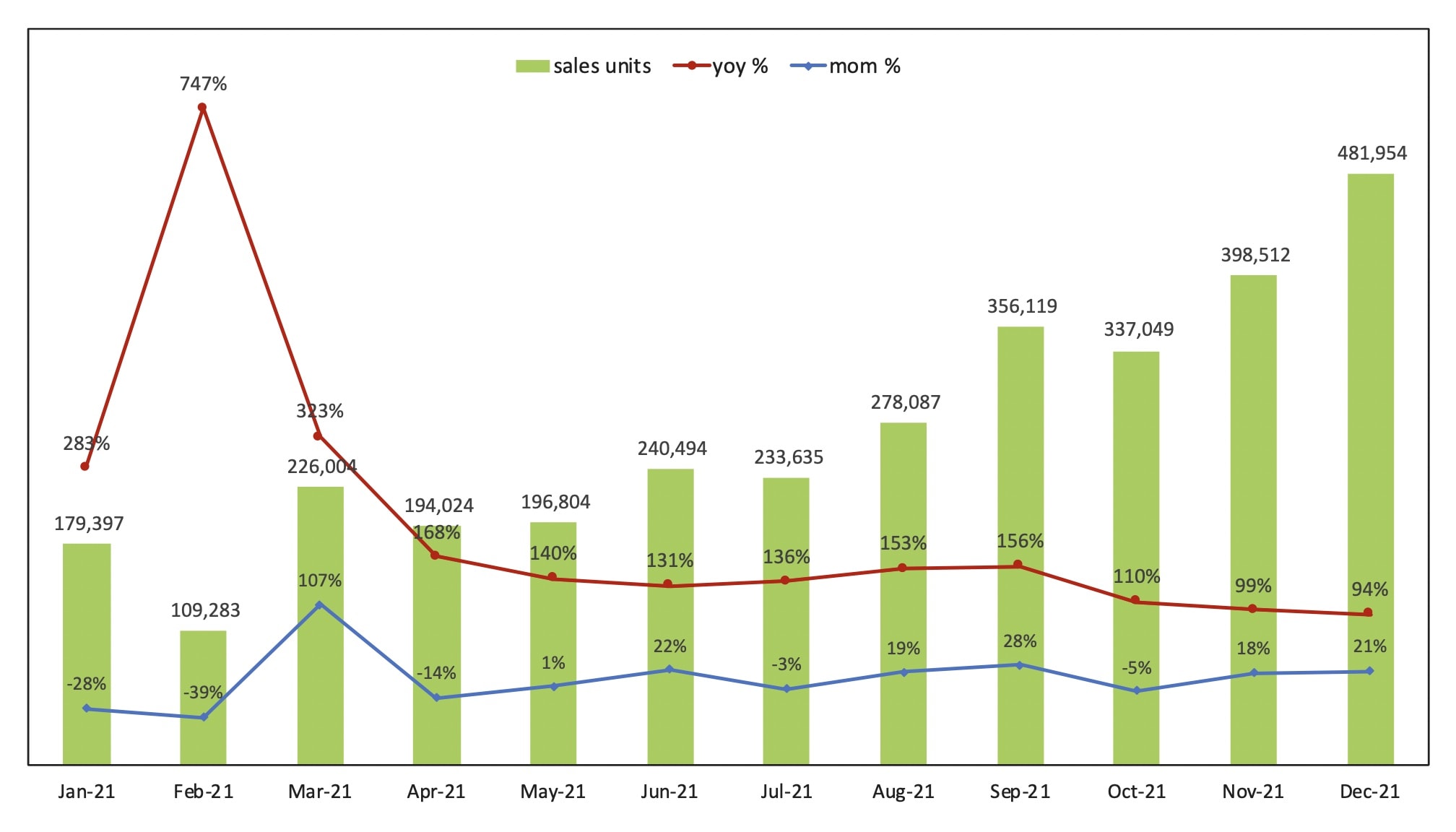

According to Researcher and Research LLC, the electric vehicle (EV) market in China reached 3,231,362 units in 2021, with an annual growth rate of 143.2%.

In terms of sales ratios for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), the figures for 2021 were 82.6% and 17.4%, respectively, and not much different from 82.1% and 17.9% in 2020.

Top 20 Best Selling EV in China with market Share 2021

| Ranking | Model | Segment | Sales (Units) | Share % | YOY % |

| 1 | Wuling Honggaung | Mini electric Car | 395,451 | 12% | 651% |

| 2 | Tesla Model Y | Mid SUV | 169, 853 | 5% | |

| 3 | Tesla Model 3 | Mid Car | 150,890 | 5% | 60% |

| 4 | BYD Qin Plus DM-i | mid car (PHEV) | 110,971 | 3% | |

| 5 | Li Xiang One | Large SUV (PHEV) | 90,491 | 3% | 304% |

| 6 | BYD Han | Large EV (BEV) | 87,082 | 3% | 592% |

| 7 | Chery eQ | Mini Electric (BEV) | 76,987 | 2% | 218% |

| 8 | BYD Song Pro DM | Mid SUV (PHEV) | 76384 | 2% | 797% |

| 9 | Changan Benni E-star | small Electric (BEV) | 76,381 | 2% | 658% |

| 10 | GAC Aion S | mid-Electric (BEV) | 69,219 | 2% | 97% |

| 11 | Great Wall Ora Black Cat | Mini Electric Car | 63,492 | 2% | 133% |

| 12 | Xpeng P7 | Large Car (BEV) | 60,569 | 2% | 581% |

| 13 | BYD Qin Plus | mid car (BEV) | 55,246 | 2% | |

| 14 | Great Wall Ora Good Cat | Compact (BEV) | 49,900 | 2% | 2375% |

| 15 | Hozon Nezha V | Small SUV (BEV) | 49,646 | 2% | 1537% |

| 16 | BYD Tang DM | Large SUV (PHEV) | 46,783 | 1% | 228% |

| 17 | SAIC Roewe Clever | Mini Electric (BEV) | 46,002 | 1% | 412% |

| 18 | Xpeng G3 | Compact SUV | 42,898 | 1% | 267% |

| 19 | NIO ES6 | large SUV (BEV) | 41,474 | 1% | 80% |

| 20 | BYD Yuan | Compact SUV (BEV) | 40,534 | 1% | 157% |

| Other Models | 1,431,109 | 44% | 50% | ||

| Totals | 3,231,362 | 100% | 143% |

CHANGAN EADO SALES IN 2021 WAS 150,000 UNIT