Table of Contents

What Is EV Tax Credit?

Incentives like the EV tax credit are offered by the federal government to encourage people to buy electric vehicles (EVs). Residents who meet the income requirements and purchase a vehicle that meets the price, battery, and assembly requirements will be eligible for a tax credit of up to $7,500.

Politicians have been trying to tackle pollution and promote the use of cleaner energy for years with this incentive, which has been around in various guises. As part of the Inflation Reduction Act, which was signed into law this year, the new version includes some important changes that are scheduled to take effect from 2023 through 2032.

Beginning in 2024, you will be able to cash in the credit when you purchase your vehicle, as opposed to waiting until tax time to take advantage of it. As soon as this incentive becomes available, you won’t need to wait until tax time to take advantage of it—you’ll be able to deduct the credit amount directly from the purchase price of your vehicle.

It is necessary to have assembled the vehicle and built the battery in North America, as well as mining or recycling battery minerals on the continent, in order to qualify for the electric vehicle tax credit. In contrast to the first requirement, which goes into effect immediately, the second requirement will be phased in gradually.

As of 2024, at least 50% of all electric vehicle batteries must come from the United States, Canada, or Mexico, with the goal of reaching 100% by 2028.

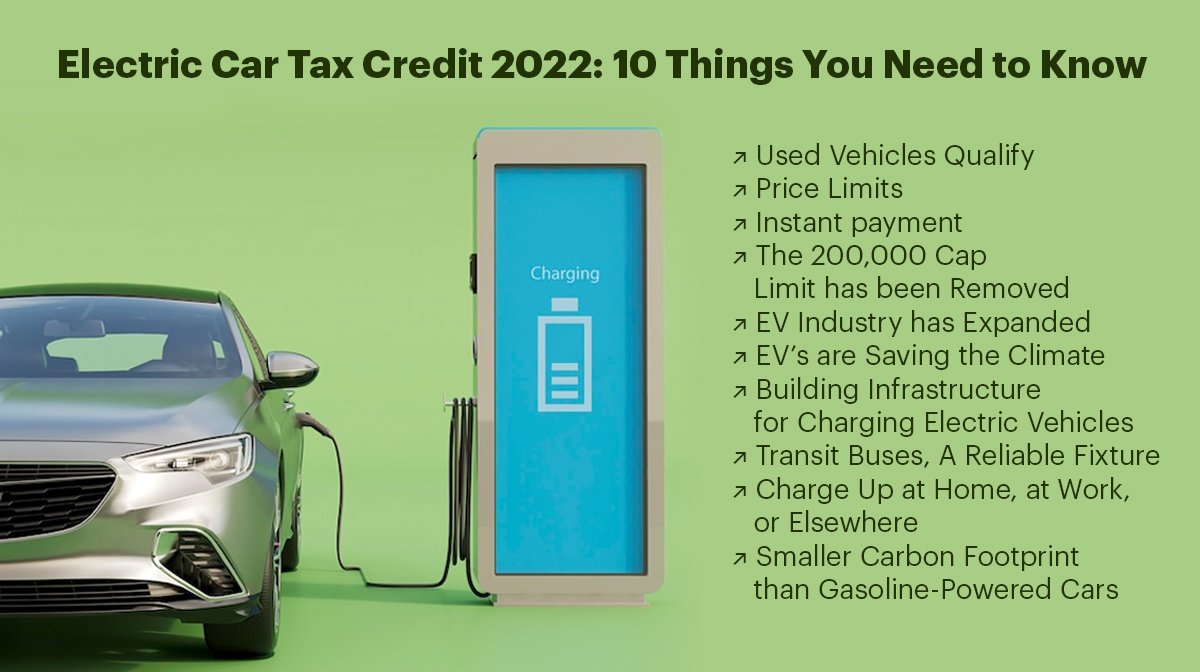

10 Things You Need to Know about Electric Car Tax Credit

Used Vehicles Qualify

A tax credit for electric vehicles used to be only obtainable when purchasing new cars. Under the Inflation Reduction Act, that has now changed; a tax credit will be introduced in 2023 for pre-owned “clean” cars that are older than two years, costing $25,000 or less, weighing under 14,000 pounds, and purchased from a dealer.

A credit of 30% of the purchase price is available, with a maximum of $4,000.

Price Limits

In addition to price restrictions, some Americans may not be able to take advantage of EV tax credits under the bill. Consequently, consumers hoping to take advantage of this break have fewer options.

Although supply chain disruptions and rising materials prices may make it unrealistic to count on that happening, new expenses such as assembling autos and manufacturing batteries in North America may be associated with that.

Instant payment

Starting in 2024, the tax credit will be eligible for cash-in at the point of sale, which is a positive development. Previously, benefits were realized on your tax return.

As soon as it becomes available, you will be able to discount the credit amount directly from the price of your vehicle instead of waiting until tax time.

The 200,000 Cap Limit has been Removed

A cap had previously been imposed on automakers that prevented them from selling more than 200,000 electric vehicles in the United States with the EV tax credit.

The limit now has been removed, making it more difficult for consumers to purchase electric vehicles at a discount from popular manufacturers like Tesla and General Motors.

The EV Industry has Expanded

The electric vehicle industry has expanded to include cars, transit buses, trucks, and even big-rig tractor-trailers that are powered by electricity at least partially. Currently, electric fire trucks and sanitation trucks are more than just passenger cars; Angelenos welcomed the first electric fire trucks in 2021, and in the coming years, electric sanitation trucks will be picking up garbage and recycling quietly through neighborhoods.

EVs are Saving the Climate

A greener world is possible with electric vehicles since emissions from cars and trucks are not only detrimental to the environment, they are harmful to our health as well. Gasoline- and diesel-powered vehicles produce air pollutants like asthma, bronchitis, cancer, and premature death. Asthma attacks, lung damage, and heart conditions are among the long-term health consequences of localized air pollution.

Building Infrastructure for Charging Electric Vehicles

In order to charge electric vehicles, states and utilities need to start building infrastructure now.

Finding a solution to charging these vehicles will become increasingly important in the coming years. Public transit agencies, businesses, and people who want to buy electric cars but can’t install a charger will find infrastructure investments increasingly important.

Transit Buses, A Reliable Fixture

Our transit system’s workhorse, buses, can possibly be the key to a revolution of electric vehicles. Buses are the workhorse of our transit system, providing affordable transportation to anyone. By 2040, every bus you ride on or wave to will be an electric bus, quiet, clean, and part of your everyday life in many cities.

They serve as a cornerstone of daily life and are an important step toward introducing big electric vehicles to the larger transportation market.

Charge Up at Home, at Work, or Elsewhere

One advantage of electric vehicles is that you can charge them up anywhere, whether it’s at home, at work, or even at the store because many can be recharged wherever they choose, whether you’re at home or at the bus station. As more electric vehicles hit the market and are used more broadly, new recharging solutions will emerge.

Electric vehicles make an excellent solution for truck and bus fleets that regularly visit a central depot or yard.

Smaller Carbon Footprint than Gasoline-Powered Cars

No matter where your electricity comes from, electric cars have a smaller carbon footprint than gasoline-powered cars. Power grids charge and fuel battery electric and plug-in hybrid vehicles, which draw on a variety of sources of energy, from fossil fuels to clean renewables.

Electric vehicle carbon footprints vary depending on the source of electricity used in an electric vehicle. Energy grids can vary from state to state.

The Bottom Line

In response to rising gas prices, Americans are increasingly discovering that driving an electric vehicle can help them save money. This extension of the EV tax credit, which can be reimbursed immediately, the expansion of the program to include other kinds of “clean vehicles,” the elimination of the 200,000-vehicle cap, and the possibility of applying the credit to used cars are all positive steps forward in the fight against pollution.

Nevertheless, other provisions in the Inflation Reduction Act may undermine those plus points. There were some significant changes to the electric vehicle tax credit under the Inflation Reduction Act, a federal incentive aimed at encouraging electric vehicle ownership.

If you meet the income requirements and purchase a qualifying vehicle, the government will provide you with a $7,500 refund. Any vehicle that qualifies as a “clean vehicle” is eligible for the credit, including pre-owned vehicles.